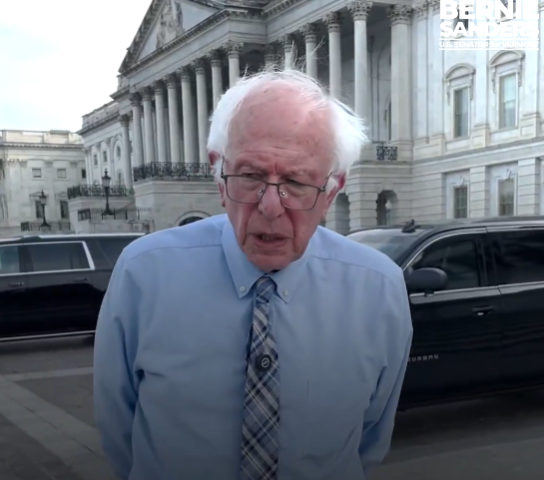

WASHINGTON, D.C. – July 1, 2025 – Senator Bernie Sanders (I-Vt.) has once again taken a firm stance against a controversial legislative proposal, describing it as a “massive wealth transfer” from the working class to the wealthy. In a video posted on X (formerly Twitter), Sanders expressed his hope that his Republican colleagues would listen to their constituents and vote against what he termed “obscene legislation.”

The legislation, which Sanders did not name directly but has been part of ongoing debates on tax policy, is criticized for potentially offering significant tax breaks to the top 0.1% while risking cuts to essential public services. “This bill is a disaster beyond words,” Sanders stated, warning of its implications for healthcare, education, and other social programs.

Sanders’ opposition aligns with his long-standing advocacy for progressive taxation and social equity. His comments echo concerns raised during his 2017 push for Medicare for All, a bill that aimed to ensure universal healthcare access but faced backlash for its proposed tax increases on the wealthy. The current proposal, he argues, could undermine the Affordable Care Act and Medicaid, programs critical to millions of Americans.

The political climate remains polarized, with tax reform at the forefront of national discourse. Sanders’ critique comes as part of a broader narrative on how fiscal policies shape economic inequality and influence upcoming elections. His call for action reflects a growing sentiment among some voters and policymakers about the need for legislation that prioritizes the working class over corporate interests.

As debates continue, Sanders’ voice remains a significant one in the conversation on economic justice, urging a reevaluation of policies that he believes exacerbate wealth disparities. The outcome of this legislative battle could have far-reaching effects on the social safety net and the economic landscape of the United States.