WASHINGTON D.C January 12, 2026. – President Donald Trump has ordered Fannie Mae and Freddie Mac to purchase approximately $200 billion in mortgage-backed securities (MBS), a direct intervention aimed at lowering mortgage rates and easing the homeownership lockout affecting millions of American families.

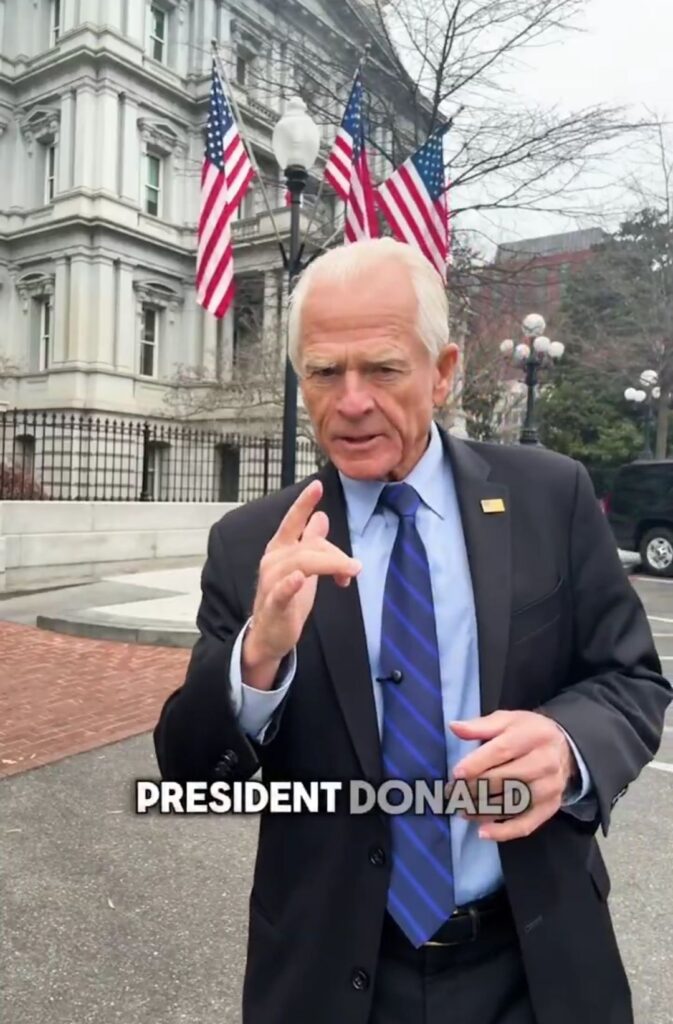

Senior Counselor for Trade and Manufacturing Peter Navarro highlighted the initiative in a video posted on X, standing in front of a government building adorned with American flags.

“President Trump is going straight after the homeownership lockout—and he’s hitting it where it actually hurts: the mortgage rate,” Navarro said. He explained that the housing crisis boils down to affordable monthly payments, not abstract policy debates. By boosting demand in the mortgage bond market, the purchases are designed to drive down bond yields, which in turn reduce mortgage interest rates.

The move utilizes existing cash reserves from Fannie Mae and Freddie Mac, allowing the administration to bypass Congress. Navarro emphasized that this addresses a liquidity shortfall in the bond market that has imposed a “hidden charge” on families through elevated rates. Even a quarter-point drop, he noted, could save homeowners hundreds of dollars monthly—the difference between renting and owning.

Recent data shows the policy gaining traction: 30-year fixed mortgage rates have fallen to around 5.91%-6.16% as of early January 2026, hitting some of the lowest levels in nearly three years.

This forms part of broader Trump administration efforts to improve housing affordability, including proposals to limit large institutional investors from purchasing single-family homes.

While supporters praise the targeted approach as “fixing a broken system” without subsidies, some economists warn of potential market distortions or complications for future reforms to Fannie Mae and Freddie Mac.